hidden

Over 10 years experience of Traceability Solutions

By Pharmatrax Author

Category: Technoloy

No Comments

No Comments

Pharma will innovate and prosper further: Top 10 pharmaceutical industry trends in 2022

Current business dynamics indicate that innovation will continue to drive growth in the 2022 pharma market. One of the leading players in the industry, Johnson & Johnson, has reported sales of $23.3bn in the third quarter of 2021, a rise of 10.7% compared to $21.08bn in the same quarter in 2020. Not solely Johnson & Johnson, but the entire industry will grow, based on projected pharmaceutical sales. While the global pharmaceutical manufacturing market has reached $402 billion in 2020, the US and European markets alone will be worth $635 and $315 billion in sales by 2024, respectively. Yet, how is the industry going to move toward 2024’s sales marker in 2022? Trends in the pharmaceutical industry and the pharma companies’ desire to follow them answer this question. Today, we will talk about the ten key pharma trends to embrace in 2022.

Pharma’s 2022 in a nutshell

The industry is in the midst of a fundamental transformation, as the scale of operations is growing. The year 2022 will have pharma companies oriented to staying agile and resilient in regards to disruption bred by the fluctuating market demands and diverse customer needs. A Deloitte’s report states that the majority of pharmaceutical companies recognize evolving customers’ behaviors and attitudes as the most significant factors of transformation. Indeed, today’s pharma clientele require revolutionary pharmaceutical solutions that will render drug development, discovery, prescription, and usage easier and more convenient.

As per Pharmaceutical Technology, a 2021 GlobalData survey revealed that 70% of surveyed pharma industry clients anticipate drug development to be the most impacted in 2022 by smart technologies, like Artificial Intelligence (AI), Machine Learning (ML), and Natural Language Processing (NLP). These are more than the expectations of those on the receiving end, but also the overall tendency that will define pharma’s 2022.

Emerging trends in the pharmaceutical industry

The industry has started focusing on its ability to meet rising client expectations with the help of AI and ML. Specific emphasis is being made on pharmacovigilance, federated learning, NLP, and computer vision. Nonetheless, 2022 calls for pharma to reach further and pay attention to all the pharmaceutical industry trends that will shape the global market this year.

1. Pharmacovigilance market will scale up

Medicines and vaccines often have undesirable and unexpected side effects. This treacherous tendency calls for more emphasis to be made on the drugs’ quality and the aftermath of their usage. So, here comes pharmacovigilance from the Greek word Pharmakon meaning a medicinal substance and the Latin word Vigilia meaning to keep watch. It is a set of scientific activities for preventing adverse drug effects and other medicine-related safety problems. Its ultimate goal is to optimize the benefit-risk ratio of healthcare products usage by sharing accurate information with patients and health care professionals.

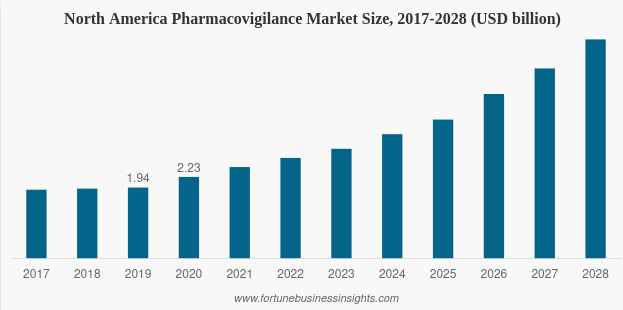

There is no doubt why the pharmacovigilance market is expanding rapidly. Fortune Business Insights reflects that the global pharmacovigilance market will grow from 2021’s $6.28 billion to $14.85 billion in 2028, a CAGR of 13.1%. Once again, Northern America, and the United States in particular, will account for the lion’s share of the market. As shown in the chart below, the market size in North America has already reached $2.23 billion in 2020, contributing to the region’s leading position in pharmacovigilance worldwide. Fig. 1. Predicted growth of the North America pharmacovigilance market

Fig. 1. Predicted growth of the North America pharmacovigilance market

The substantial surge of global databases in recent years is causing the industry to be oversaturated with data; this can hamper the detection of either positive or negative trends. That is, excessive data distortion can prevent companies from identifying medication errors, off-label use cases, acute and chronic poisoning, as well as many other detrimental drug effects.

Meanwhile, developing safe and effective medicine, in addition to building secure preclinical and clinical software, takes huge amounts of high-quality data. Given that pharmacovigilance makes it possible for companies to apply data mining for critical decision-making and risk assessment, it becomes clear why it will be the number one trend in pharma for years to come.

2. High-tech will fuel advancement in R&D

Ten American pharmaceutical companies, which have sent 106 new drugs to the market during 2013-2021, have spent an average of $2.8 billion on testing, marketing approval, and post-approval research and development (R&D). While the R&D phase remains crucial to the industry’s “end-users”, it is hard to deny that the price noted above longs for an improved cost-efficiency ratio.

Continuous digital transformation, aimed at lowering the R&D price while simultaneously enhancing its efficiency, will become one of the leading tendencies in 2022. High-tech solutions for R&D can help pharma organizations refine multiple processes:

- Identify appropriate drugs for specific conditions

- Run cost-effective trials for drug design

- Accurately allocate resources to start and change medical treatments

- Improve algorithms for drug research and development

- Offer valuable insights into business strategies

- Gather health data more efficiently

- Improve patient engagement

The list above justifies that 63% of respondents in a recent Deloitte report considered R&D one of the key priorities for their business development in the next five years. Life-sciences companies worldwide aim to refine the production cycle with AI, ML, cloud technology, and other digital investments over the coming years.

3. Data analytics will accelerate biotechnology innovation

Why are certain drugs effective while their alternatives cannot be used for treatment? Machine Learning algorithms can assist in finding the answer to this question, but the technology requires data analytics. Combining these tools can also boost predictive medicine and make it possible to track the effects of different therapies on groups of patients over time.

Given the rising knowledge about genetics and diseases, the life-sciences industry is interlinked with data analytics as never before. Exploring big data can be especially useful for identifying specific patterns in clinical trial results and enhancing drug development. Understanding implicit patterns in big data can also help manufacturers predict patient responses to medications and analyze diagnostic results more efficiently. Furthermore, the market of data analytics is expected to expand rapidly. According to Shanhong Liu, a research expert in the global software development industry, the size of the business intelligence and analytics software application market will reach around $16.5 billion in 2022.

Here are some of the benefits of implementing big data analytics in the pharmaceutical and healthcare industries:

- Early stage disease detection and high-risk patient identification. Today, it is possible to identify specific patterns of how a patient is likely to metabolize drugs. Having these predictions at hand is an especially beneficial tool in oncology and neurology.

- Preventative care strengthening. Big data analytics allows health care professionals to select treatment plans that are tailor-made for the unique needs of their patients.

- Modeling of disease spreading and the development of new mass disease prevention strategies. Technologies can make it possible to prevent and control pandemics via close contact screening, online public opinion monitoring, virus host analysis, and pandemic forecast evaluations.

Data analytics applications within the pharmaceutical industry are still accompanied by challenges, such as finding the right partners and regulatory expertise for advanced innovation. However, 2022 is likely to bring advancement in this field.

4. New operating models will bring much-needed agility

The industry’s transformation heavily relies on new capacities and talent. Given an increasing volume of distributed remote work, organizations are reevaluating their network costs and operating models. This trend is likely to cause talent distribution, making manufacturing more flexible. For instance, the requirements to work on-site may become less acute. The post-COVID-19 workforce will, therefore, be more resilient to changes, which can lead to more well-distributed organizations.

It also demonstrates a newly emerging need for talent to be able to program, operate, and interpret data while keeping up with technological advancements. This process will also create up-skilling and integrated capacity-building while helping employees stay responsive to changes.

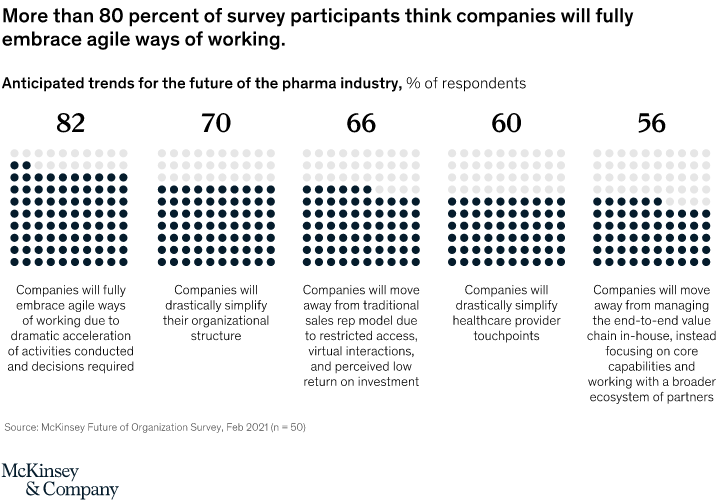

Here’s a look at some of the major pharma trends for 2022 where agility and reorganization are topping the charts. Fig. 2. Potential changes in operating models within pharmaceutical organizations

Fig. 2. Potential changes in operating models within pharmaceutical organizations

In the McKinsey & Company survey, more than 80% of the US pharma companies’ executives believe that companies will rely entirely on agile working methods. These pharmaceutical trends also indicate that organizations may simplify their structures and avoid the traditional sales rep model.

5. Natural Language Processing (NLP) will advance communication in the industry

NLP is progressing faster than any other AI subfield. With year-on-year growth in the AI software market exceeding 100%, the experts expect its worldwide revenue to reach around $126 billion in 2025. NLP will take credit for a substantial share of the AI growth, especially when it comes to AI application in healthcare and life sciences. This segment of the NLP market is predicted to reach $4.3 billion in 2026, compared to 2021’s $1.8 billion.

Pharmaceutical organizations worldwide have started to make use of NLP to leverage insights from unstructured medical data. Indeed, NLP is becoming instrumental in accelerating and refining clinical trials. For example, an NLP-assisted dataset analysis within clinical trials helps identify doctors-influencers within a specific dataset(s) and expertise, and thus tackles the overarching problem of timely patient recruitment. The technology is also being used for finding principal investigators that can source considerable numbers of eligible patients that fit a clinical trial’s inclusion criteria.

6. Digital tools will improve patient outcomes

Digital tools, including telemedicine and remote-working instruments, are bound to change patient interactions and make access to healthcare services easier. Embracing new technologies will open up alternative opportunities for more precise chronic disease management. For example, as telemedicine and virtual care programs allow health care professionals to monitor patients remotely, it is also possible to record and analyze various types of personal information for more accurate treatment plans.

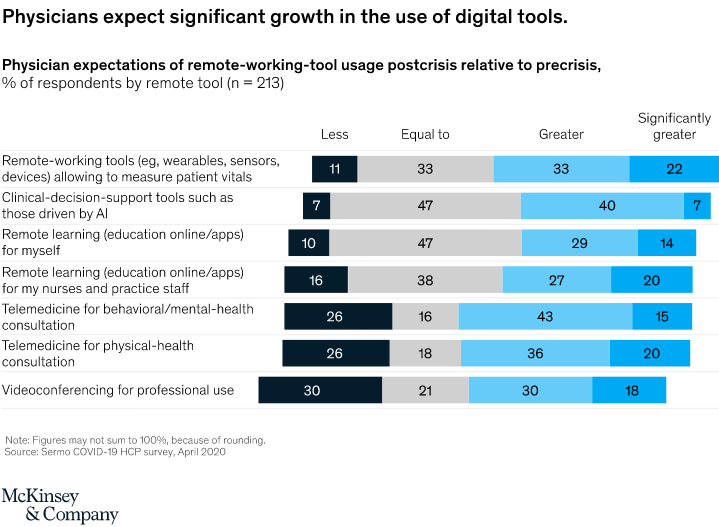

Remote-working tools, particularly wearables, sensors, and devices, as well as telemedicine for physical-health consultations, are likely to become more popular with health care professionals and their patients. Fig. 3. Physician expectations of remote-working-tools from the postcrisis perspective

Fig. 3. Physician expectations of remote-working-tools from the postcrisis perspective

The use of digital tools embraces the emergence of new hybrid operating models. Promoting these tools can improve a higher level of access to health care services. Meanwhile, the pharmaceutical industry can leverage data in order to keep up with public health challenges.

7. Real-word-evidence will promote vaccine development

Real-world-evidence (RWE) is nothing new to the pharmaceutical industry. However, its recent advancement makes it one of the latest pharma industry trends. Some three years ago, RWE was mainly used for analyzing electronic health records and data from wearable devices so as to complement clinical trials data. Today, it has sprung up as one of the major tools for vaccine development and testing.

In 2021, RWE significantly contributed to clinical research, making it possible to understand how patient characteristics and behaviors affected health outcomes. Using RWE allows for predicting the progression of a disease and exploring the effectiveness of any vaccines or therapy. It can also be used to develop prevention strategies and accurately determine the effectiveness of future treatment.

One of the 2021 studies relied on RWE to find out whether the two FDA-approved COVID-19 vaccines could effectively prevent SARS-CoV-2 infections. RWE also provided opportunities to track the effectiveness of the COVID-19 vaccine against death, hospitalization, and transmission in vaccinated people all over the world. Given the rapid advancement of RWE’s use, its market is expected to reach $3.13 billion by 2027. This growth will have a direct impact on vaccine development in 2022.

8. CDMO market growth will bring resilience to the market

Faster time-to-market and improved cost-efficiency are the primary reasons for the popularity of outsourced manufacturing services. According to Grand View Research Inc., the investigational new drug CDMO (contract development and manufacturing organizations) market will reach a market size worth $6.8 billion by 2028, while the conventional CDMO market will grow to $117.3 billion by 2023.

The overall potential for CDMO engagement will rise as well, mirroring the outsourcing model’s increasing popularity. These organizations offer exceptional value in the pharmaceutical sector, providing such services as:

- Product development

- Clinical testing

- Commercial manufacturing or API and drug products

- Regulatory support

CDMOs will find new market opportunities with the growing number of small and medium-sized pharmaceutical companies, which are responsible for an increasing share of new drug approvals and who often have no manufacturing capacity of their own.

9. Deep learning to transform adverse events monitoring

Adverse event reports are saved in various formats and are highly fragmented. At the same time, the amount of reported adverse events is growing every day, making it more challenging to analyze and process all the reports and, thus, define the most important ones. As the global pharmacovigilance market is expected to expand in value to almost $15 billion by 2028, deep learning (DL) can significantly contribute to the advancement of anomaly detection and adverse event monitoring.

Machine learning (ML), and its subfield of deep learning in particular, has an enormous potential to facilitate adverse event analysis. Statistical methods can correctly elicit and validate adverse events and exclude noise-induced ones. Deep learning automates previously manual routine and bothersome processes. It can be utilized to analyze large datasets from genetic screening and high-content imaging. In this way, DL provides contract research organizations (CROs) and company sponsors with comprehensive insights about the tested drug.

10. Improved cybersecurity will remain a must

The pharmaceutical industry is a source of the most sensitive data a cyber perpetrator can steal. A new report by Reposify shows that 92% of the companies have had their databases exposed to potential leakage at least once, while 46% had an exposed Server Message Block (SMB) service. The danger can emerge in different sources and forms, from unauthorized access to third-party vendors to phishing attacks and employee errors. The never-ending introduction of new technologies guarantees that pharma organizations are bound to face security risks.

The year 2022 is about to put even more emphasis on cybersecurity. The 2021 published proposed modifications to HIPAA and HITECH will take effect in 2022, having pharma entities and business associates rethinking the impact of personally identifiable data within the organizations’ proper functioning. For example, HIPAA-covered entities will be required to post estimated fee schedules on their websites for PHI access and disclosures, and provide individualized estimates of the fees for an individual with a copy of PHI.

Organizations will have to swiftly adjust to the challenge as the situation calls for more comprehensive cyber security protocols. Compliance with international cybersecurity standards, such as ISO27001, SOC 2, and GDPR, will remain even more relevant in building a trustworthy reputation. Furthermore, regional regulations, including CCPA, NIS, the Data Protection Adaptation and Implementation Act, and others, will also play their part in forming a secure business environment for pharma companies and their customers.

Reimagining the pharmaceutical industry in 2022

The pharma market is changing in response to the rapidly evolving expectations of customers and investors. COVID-19 didn’t reshape the whole industry. On the contrary, it only fueled the development of pre-existing pharmaceutical trends, most notably in patient engagement and digitalization. If you’ve been following recent trends in the pharmaceutical industry, you should be ready for 2022.

Source: https://www.avenga.com/magazine/pharmaceutical-industry-trends/